|

DB On April 28th, McKinsey & Company's Global Managing Partner, Kevin Sneader appeared on CNBC to discuss how his firm is advising multiple governors on when and how to reopen their states. In his words, the decision hinges on one question: how do you reconcile the saving of lives with the safeguarding of livelihood? |

|

|

|

How This Could Unfold |

|

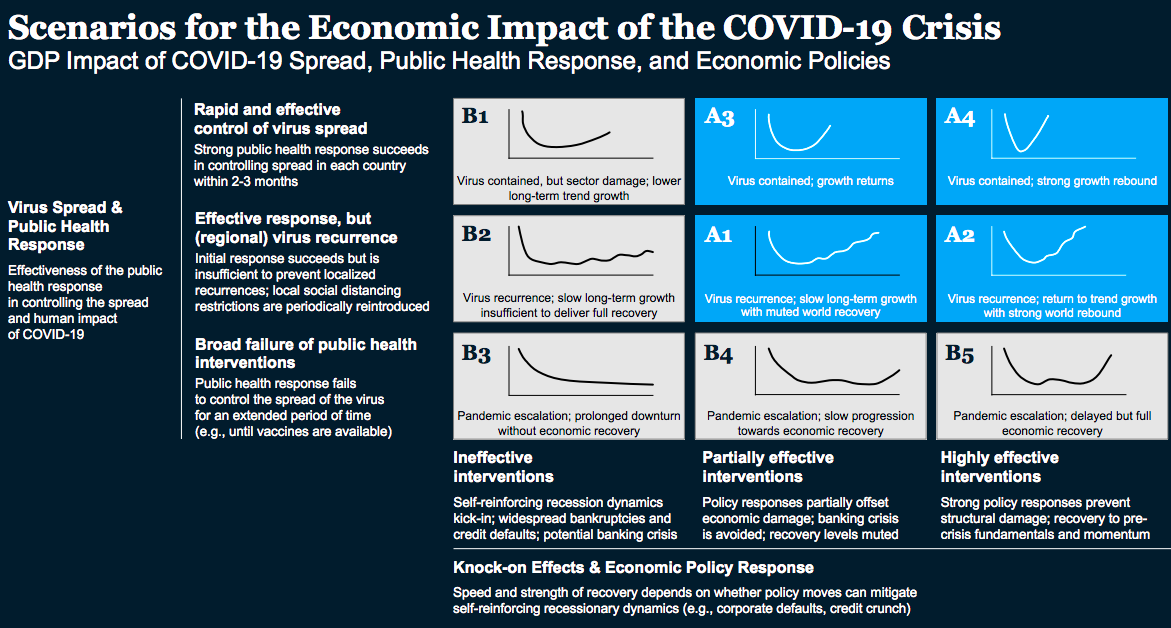

A recent survey of over 2,000 global executives showed that many expect the recovery to look like one of the scenarios shaded in blue below (A1–A4) which lead to a V- or U-shaped recovery. In each of these, the COVID-19 spread is eventually controlled, and catastrophic structural economic damage is avoided.

Almost one third of these leaders anticipate a muted world recovery where US GDP could drop 35-40% in Q2 of 2020 and won't return to pre-crisis levels until Q1 of 2023 (A1). A slightly more optimistic outlook was the second most anticipated scenario, reflecting virus containment by mid-Q2 of 2020 with an economic rebound following Q2 2020 (A3). [Source: McKinsey] |

|

|

|

Which Sectors are being Hit the Hardest? |

|

1. Commercial Aerospace |